north carolina estate tax return

105-1535a2 allows a taxpayer in calculating North Carolina taxable income to deduct from adjusted gross income either the North Carolina standard deduction amount or the North Carolina itemized deduction amount. Skip to primary navigation.

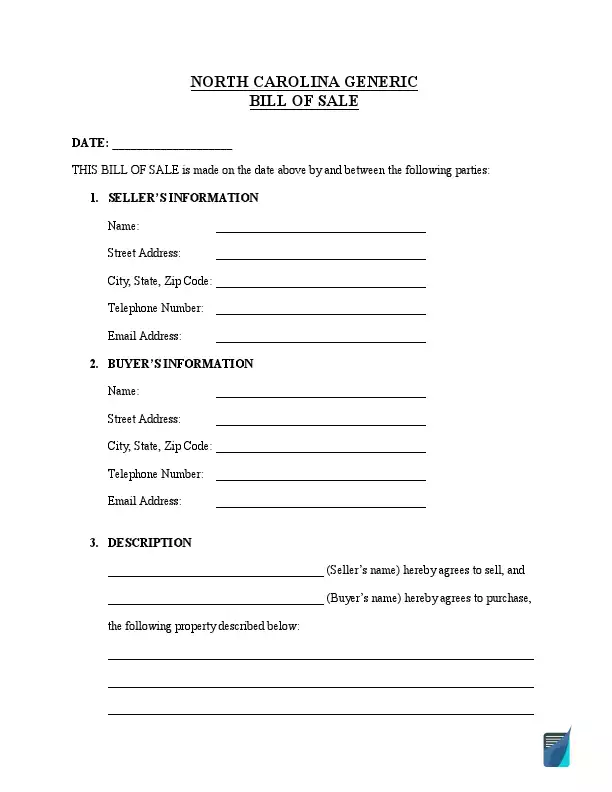

Free North Carolina Bill Of Sale Forms Formspal

In other words you can make up to 16000-worth gifts to as many people as you wish every year.

. In North Carolina include a complete copy of Federal Form 706. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706. PDF 1874 KB - November 27 2017 Estates and Trusts Fiduciary Partnerships Individual Income Tax.

Complete this version using your computer to enter the required information. Due by April 15 of the year following the individuals death. Attend A Free Webinar - KY Attend A Free Webinar - NCSC THIS IS AN.

Due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period. Then print and file the form. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

PO Box 25000 Raleigh NC 27640-0640. NC 704 944-3245 KY 606 324-5516. 1999 Form A-101 North Carolina Estate Tax return Use this form only if death occurred on or after January 1 1999 Files.

The federal gift tax has an annual exemption of 16000 per recipient. Estate Trusts. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706.

What Is North Carolina Estate Tax. Individual income tax refund inquiries. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions.

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. If the decedent owned property in two or more states the credit must be prorated between those states by completing Schedule Z below. A fiduciary must file North Carolina Form D-407 for the estate or trust if he is required to file a federal income tax return for estates and trusts and 1 the estate or trust derives income from North Carolina sources or 2 the estate or trust derives any income which is for the benefit of a resident of North.

When an estate is subject to the death tax an estate tax return must be filed with the Internal Revenue Service. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706. Direct Deposit is available for North Carolina.

Non-resident NC state returns are available upon request. What Is North Carolina Estate Tax. North Carolina does have income tax but it doesnt have an estate tax or gift tax.

Federal estate tax return. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal tax return for. These should all be considered when you look at the overall state tax structure.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. North Carolina Department of Revenue. North Carolina Estate Tax Return - 2000.

PO Box 25000 Raleigh NC 27640-0640. Link is external 2021. What Is North Carolina Estate Tax.

2020 D-407 Estates and Trusts Income Tax Return. Prior to January 1 1999 North. Preparation of a state tax return for North Carolina is available for 2995.

An addition is also required for the amount of state local or foreign income tax deducted on the federal return. The Potter Law Firm. Application for Extension for Filing Estate or Trust Tax Return.

Prior to January 1 1999 North. Federal estatetrust income tax return. E-File is available for North Carolina.

When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the same time the federal estate tax return is due which is currently nine months from the date of death. NC K-1 Supplemental Schedule. If the decedent owned property in two or more states the credit must be prorated between those states by completing Schedule Z below.

2021 D-407 Estates and Trusts Income Tax Return. Skip to main content Menu. Form A-101 should be mailed to the North Carolina Department of Revenue Post Office Box 25000 Raleigh North.

Owner or Beneficiarys Share of NC. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the same time the federal estate tax return is due which is nine months from the date of death. Beneficiarys Share of North Carolina Income Adjustments and Credits.

North Carolina Department of Revenue. North Carolina and Kentucky Estate Planning Attorneys. Prior to January 1 1999 North.

North Carolina Department of Revenue. A married couple can gift away up to 32000 to. If the decedent owned property in two or more states the credit must be prorated between those states by completing Schedule Z below.

2021 D-407 Web-Fill Versionpdf. This is required only of individual estates that. PO Box 25000 Raleigh NC 27640-0640.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. Make sure you review your estate situation with a qualified attorney and tax professional.

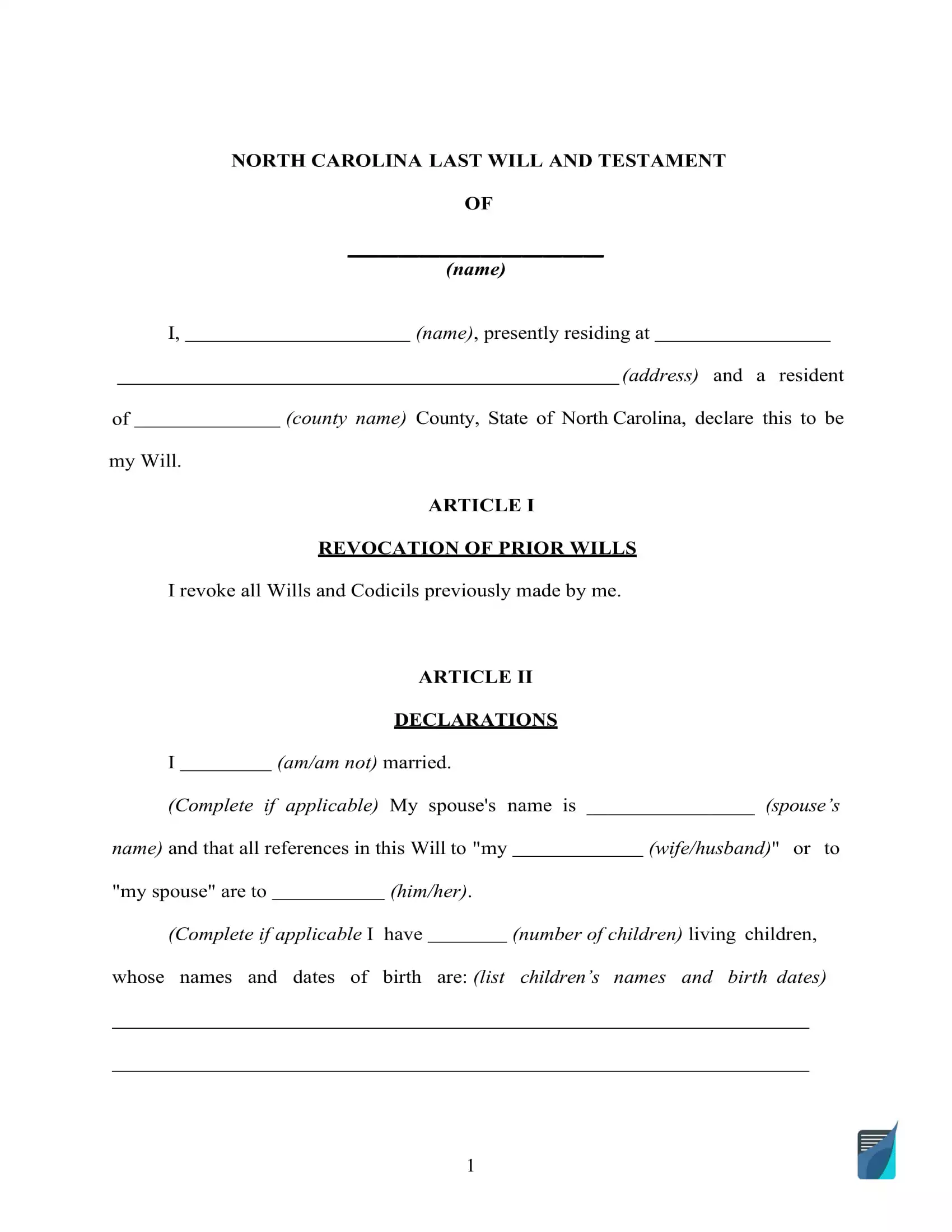

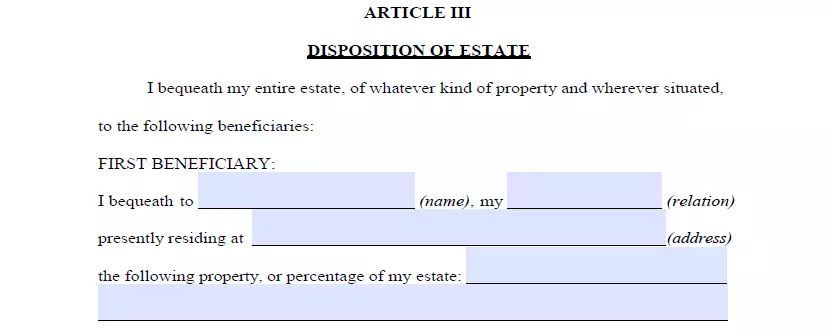

North Carolina Last Will And Testament Form Nc Will Template

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

North Carolina Last Will And Testament Form Nc Will Template

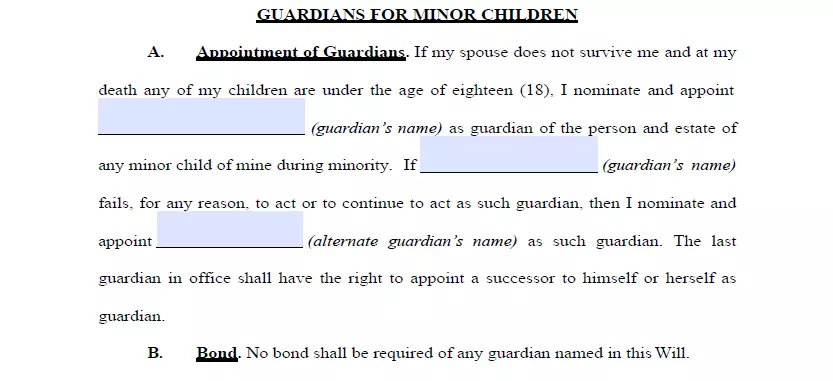

North Carolina Last Will And Testament Form Nc Will Template

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

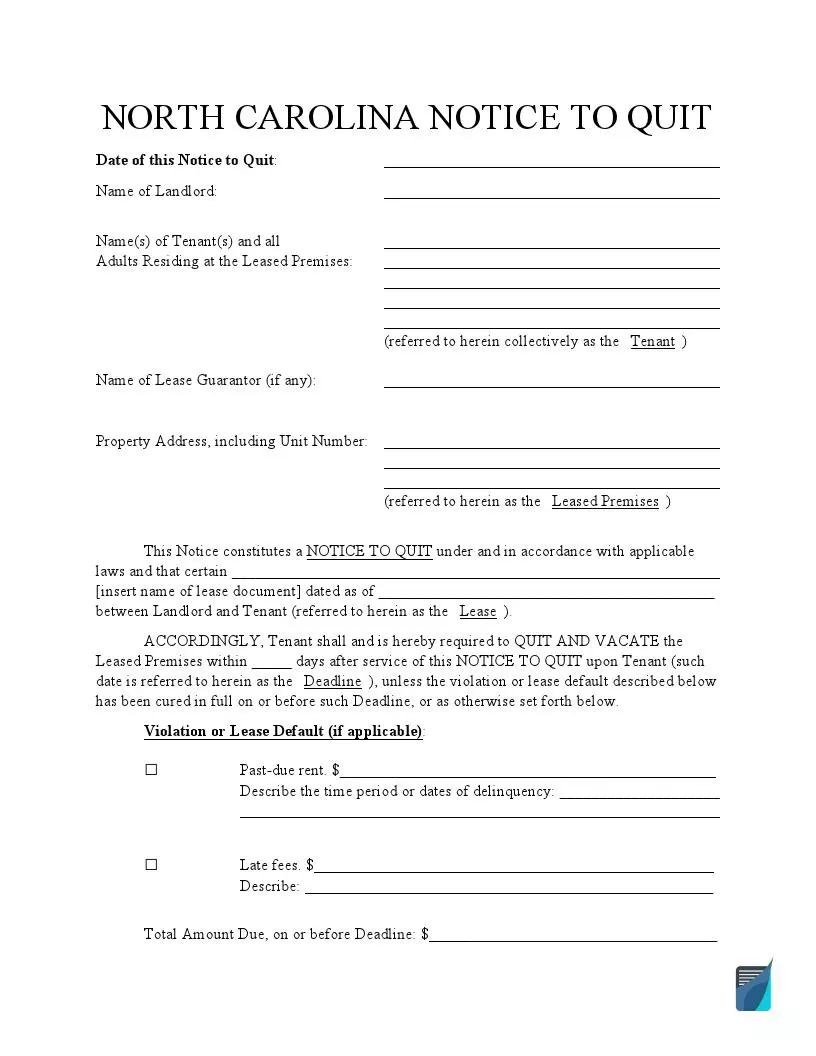

Free North Carolina Eviction Notice Forms Nc Notice To Quit Formspal

A Guide To North Carolina Inheritance Laws

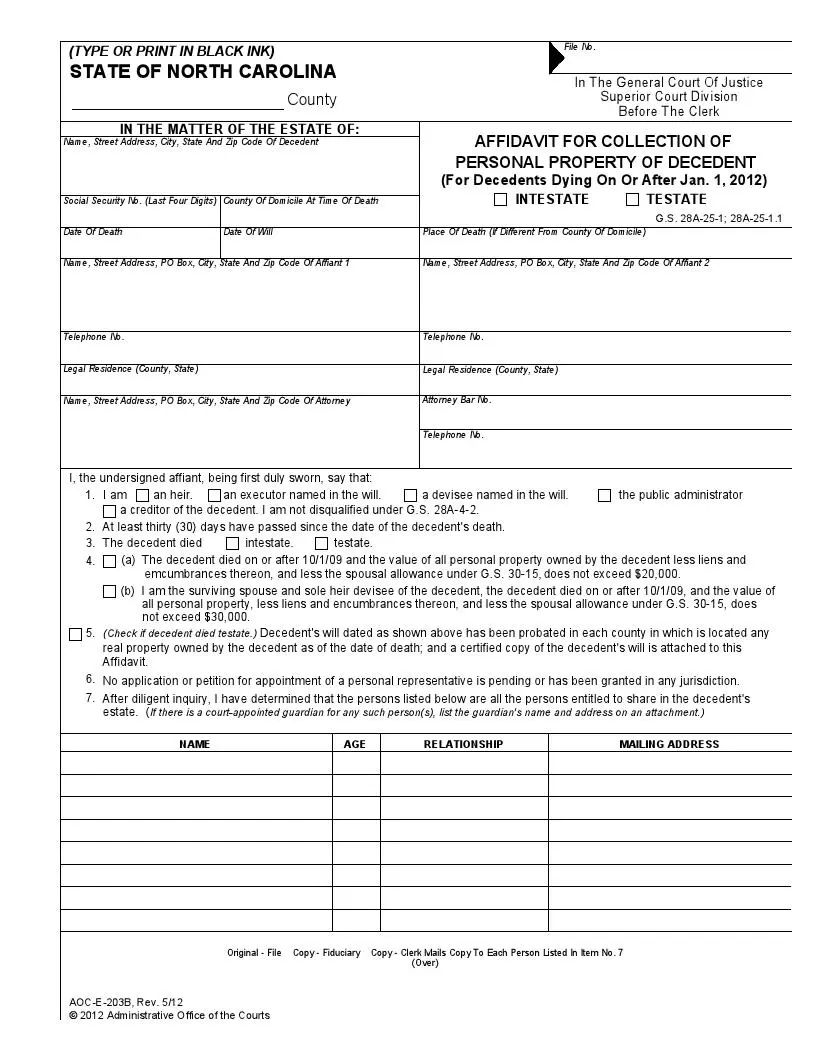

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Sales And Use Tax Update

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

A Guide To North Carolina Inheritance Laws

How Do State Estate And Inheritance Taxes Work Tax Policy Center

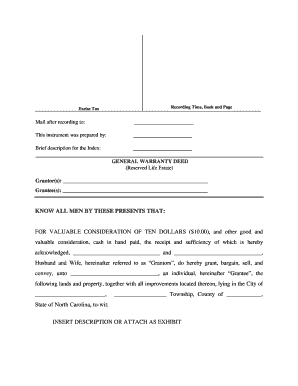

Life Estate Deed Form Fill Out And Sign Printable Pdf Template Signnow

Do I Have To Pay Income Tax On My Trust Distributions Carolina Family Estate Planning

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Free North Carolina Small Estate Affidavit Form Pdf Formspal